Working Holiday Earnings and Expenses | New Zealand

Wondering how much your Working Holiday Experience will cost? Worried you might return with a debt? Well, here’s a post to answer all your queries and help in your decision – and budgeting – before embarking on this incredible experience.

Overview

This is a personal overview of how my finances went over two years while I was on the Working Holiday experience in New Zealand. Everyone’s expenditure behaviour differs. Income and spending would also differ depending on external market factors, like the pandemic, ongoing wars, and the climate.

An Unusually Long Experience Spiked by The Pandemic

A two-year-long working holiday experience? Yes! Back in pre-covid days, Singaporeans could only stay in New Zealand for 6 months on the Working Holiday Visa and maybe another 3 months of voluntary extension. I entered New Zealand in the middle of December 2019, thinking I’ll spend just 6 months here before exploring elsewhere.

But the pandemic struck, and New Zealand closed itself from the rest of the world for the next two years. No complaints! I was happily stuck in this beautiful country with the immigration generously dishing out free extensions every 6 months.

With the borders closed and anxious working holidaymakers going home, there was a shortage of workers. Those of us who decided to stay put saw wages increase and a surplus of jobs as employers tried to lure in workers.

In the months during and immediately after the 2020 country-wide lockdowns in New Zealand, we saw historically-low fuel prices. As the hospitality industry started to pick itself up from the aftermath of lockdowns, attractions and activities like bungy jumping and Doubtful Sound Cruise were giving out attractive discounts.

We went with the flow – worked hard, played harder.

My Relationship with Money

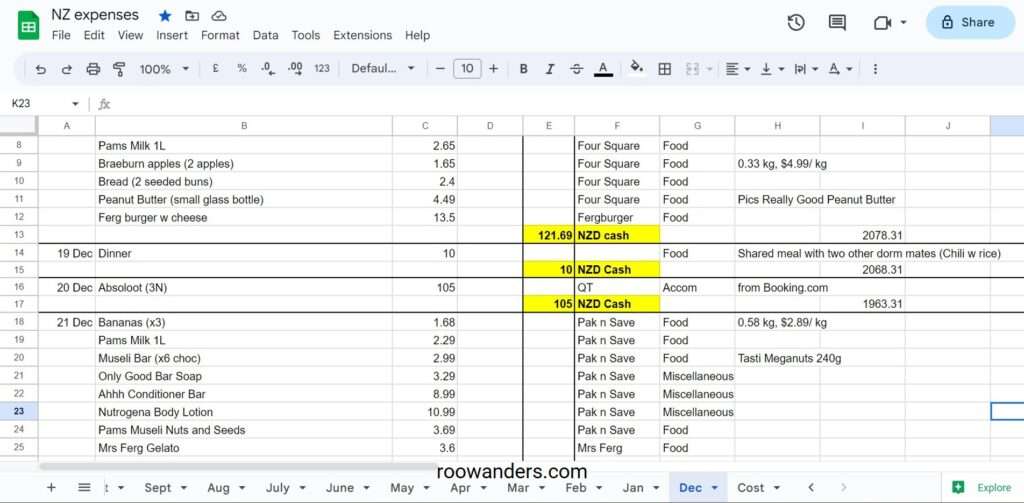

I keep track of my expenditure as I was genuinely interested to see how my living expenses in New Zealand would pan out. The information you’ll read from this post was all from this weird habit of mine where I extensively log all my money movements.

I kept receipts and keyed all information into Google Sheets once a week. The info is detailed to the extent that I even know the price of bananas I bought in Foursquare, Queenstown on my first week in New Zealand! A bit aunty, but this information helped me realise that there are foreseeable price fluctuations in some groceries, like tomatoes. I knew where to get the cheapest rice or vegetables or beef chuck for my hotpot gathering or fancy homemade dinners.

Taxing? Not so much for me. I see it as a hobby. I first scrutinised my expenditure during my exchange in Austria as a student. Proper money management was important when I wasn’t earning and was living on my savings and the scholarships I received. Europe was expensive when the exchange rate was S$ 1.65 = EUR 1. That episode made me mindful of money. Besides, it was fun to reminisce when I look through my past expenditures.

Pre Working Holiday Expenses

I set the idea of pursuing the Working Holiday in stone by spending NZ$ 245 on Nov 2018 for the visa.

Then I splurged on another S$ 1,400 months later for a return flight on Air NZ, with the landing destination at Queenstown in Dec 2020, and the exit at Auckland, exactly 6 months later.

Before Wise or Revolut came into the picture, it was cash of NZ$ 2,250 that physically went with me into New Zealand. That money was all I took from my SG funds throughout the two years in New Zealand, which was written as a condition on the application page. I wanted to see – and challenge myself – if that fund was truly sufficient, and also to – just in case, have the hard evidence ready – comply with the conditions should the immigration ask. You need not worry about the latter. A bank statement would suffice.

Earnings

Jobs are plenty, and it really depends on the Working Holidaymaker if he chooses to do it or not. Throughout my sojourn in New Zealand, I managed to score 14 different jobs. You can read most of the jobs I did here. My main New Zealand Working Holiday Guide is useful for those who don’t know where to begin their research.

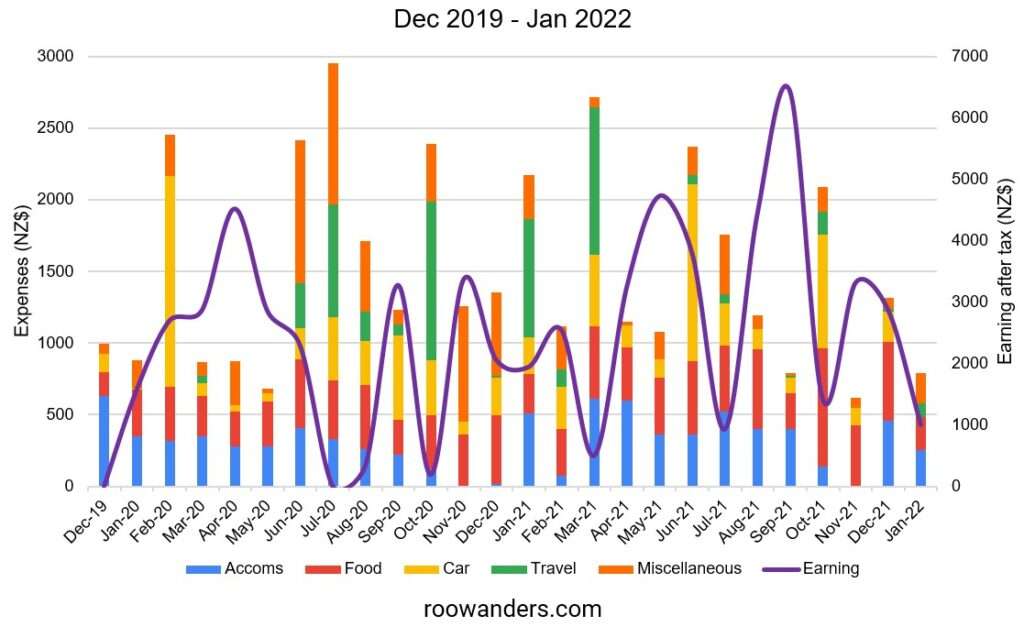

I had no income in my first month of Dec 19 – Jan 20, between mid-June – July 2020, and the month of Mar 2021. The first month was just draining the initial sum I carried as I chose to land in the most expensive place – Queenstown – on a festive period when no one was hiring. It took me a month to find work in Christchurch. Other non-earning months were spent exploring New Zealand.

I earned, on average NZ$ 2,600 a month after tax, though there are major fluctuations with min at NZ$ 190 and max at NZ$ 6,400. The lower values meant I probably wasn’t in a full-time role for the entire month. I earned the most rearing lambs as the hourly wage was high and the hours were long (more than 10 hours, one day rest/ week roster). The hours as an apple packer during the 2020 pandemic were long as well during peak harvest (April 2020), but wages were low (minimum wage).

Some of the earnings are reported lower than their true value as employers auto-deducted our rentals from our salary slips. This happened when I did hops training, cherry picking and blueberry picking.

Take note that the minimum wage increases every year. Mine went from NZ$ 17.70 to NZ$ 18.90 and finally NZ$ 20 by the time I left.

Expenses

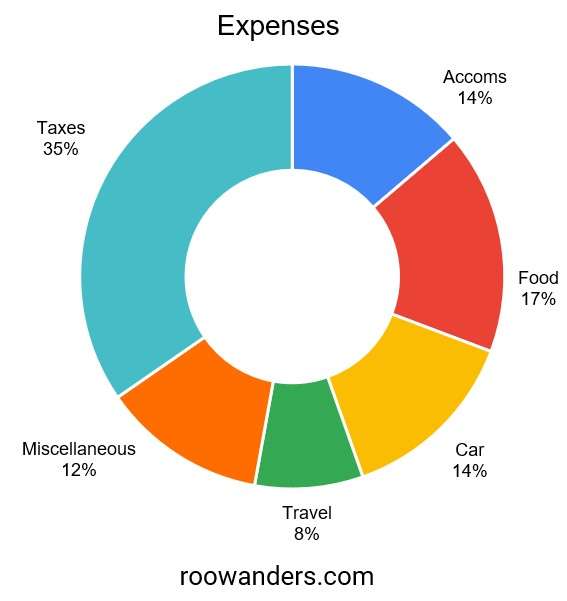

Here’s a pie chart documenting my expenditure, broken down into six categories. Percentages are used as absolute numbers are not useful in the discussion when the time you and I stay in New Zealand is different.

Tax

My biggest expenditure goes to tax – a whopping 34%! – and you can’t run away from that if you’re earning from an income or your bank’s interest.

Taxes are automatically deducted from your weekly payslip, but IRD will auto-refund excess tax once a year after the yearly assessment. Make sure you have your bank account details logged into your IRD.

New Zealand observes a progressive tax system. Most of our tax as a Working Holiday Maker should fall under the brackets of 10.5% for the first NZ$ 14,000, and 17.5% for amounts over NZ$ 14,000 to NZ$ 48,000.

Unless you’re here to make a huge pot of gold, it is not easy to earn over NZ$ 48,000 without slogging over long hours.

Food

Tax aside, I spent a considerable amount on food. On average, NZ$ 400 went to food every month, or about NZ$ 100/ week.

Most of my food expenditure goes to groceries, and we eat home-cooked meals most of the time when we work. We dined out at restaurants only once a week. Meals at restaurants average to be about NZ$ 20 – 50 per person. We usually shop once a week or every fortnight to replenish our stocks and can spend up to NZ$ 400 for two per grocery run.

Food expenditure is highest on months I travel, such as Jul 2020, when we explored the South Island and ate out almost every day, and Mar 2021, when we explored the North Island.

Oct 2021 had the highest food expenditure at over NZ$ 800 as we did another round around South Island after the lambing season and stocked up in Christchurch in preparation for hops training.

Accommodation

Accommodation is the next biggest expenditure segment. This section may be higher in reality as some of the rentals were directly deducted from our salary for jobs with lodging. I’ve also included the cost of places we stayed during our travels in hostels and Airbnb.

The cheapest lodging I’ve paid was zero as a calf rearer, as this was provided. In general, my average lodging costs around NZ$ 120/ person for a furnished room for two, with utilities included when I was based in a town for work. The cheapest I’ve stayed cost NZ$ 70/ week in Motueka in a disused motorhome. I spent my 2020 lockdown and mussel opening and apple packing season there.

Before we bought a camper car, our travelling expenditure in hostels averaged a max NZ$ 30/ day per person. We’ve also crashed at friends’ places and paid NZ$ 10/ day to sleep on their couches or our sleeping mats.

Car

Expenses on cars include the purchase of a second-hand car, WOF and REGO, maintenance, insurance, petrol, and parking. I’ve written a guide on car purchases in New Zealand here.

I’ve also lumped my transport fees for my first three months in New Zealand under this section. The expenses were mostly shared fuel costs and the bus ticket from Queenstown to Christchurch.

This section should be lower than reported as the latest car my partner and I jointly bought was sold off a few months after I left New Zealand but the data wasn’t captured.

Our arrangements when we travelled together was he drives - I'm too scaredy cat while he loves driving - and pay the fines, while I paid for WOF, REGO, maintenance and insurance. We split the fuel cost and parking fees.

Second-Hand Cars

Our three cars averaged to be around NZ$ 3,000 each. Depending on the car’s manufacture year, you could be spending WOF twice. WOF averaged to be around NZ$ 50 for me. When WOF fails, you spend more to rectify the problem. My failed WOF was related to tyres, which cost about NZ$ 130 for two second-hand tyres. I changed flattened tyres and did car servicing a few times over the two years.

You must pay REGO – road tax – to drive, which cost around NZ$10/ month.

Automobile insurance is a must, and I paid around NZ$ 50/ month for comprehensive coverage with windscreen protection for our camper car. Insurance is a life saviour when there’s an accident.

Speeding Tickets

Speeding fines are atrociously expensive, so make sure you stay away from that. In the first three months I drove, I did not encounter speeding tickets. Thereafter, all driving went to my partner, and he had been fined a couple of times, ranging from NZ$ 50 to NZ$ 80.

Petrol

Expenditure on petrol fluctuated between prices, the car, and our travel plans. The cheapest petrol I’ve seen was NZ$ 1.747/ L at Pak n Save Moorhouse in Christchurch in Sep 2020. We usually fuel at Pak n Save after our grocery run, or at NPD if we were travelling. Gull Hewletts in the North Island has cheap fuels too.

You could track the cheapest fuel or petrol stations around your area with the Gaspy app.

Travel

The travel section captures all the touristy or leisure activities I took in New Zealand. Some examples include skydiving, skiing/ snowboarding and Great Walks – like renting mountain bikes and charting a private one-way flight for Heaphy Track. That multi-day trek cost me nearly NZ$ 500.

Some of my expensive day-long travel expenses include the 7-hour Waitomo Caves expedition at NZ$ 416 from bookme, heli hiking fox glacier at NZ$ 399, and two dives, all-inclusive, at The Poor Knights Islands for NZ$ 360.

I’ve also captured crossing the Cook Straits under this section. Tickets cost less than NZ$ 250 for two, including a car.

Miscellaneous activities like bowling, ice skating, hot pools and movies are also categorised under this section.

Miscellaneous

Miscellaneous captured items like telco, gifts, clothes, hiking gear, and personal insurance (I bought OrbitProtect). Basically all random items that cannot be categorised elsewhere. Sunblock, moisturiser, and skin care products go in here too.

The PCR test for my flight back to Singapore is also captured here. That cost me NZ$ 235.

Clothes and Hiking Stuff

I bought all my thermals and hiking gear in New Zealand – remember I planned to stay for just 6 months? – which explains the huge miscellaneous expenditure in the winter of 2020. My hiking boots from Singapore were worn out after a year of hiking, and I bought a new pair in Nov 2020.

The Macpac sleeping bag was my most expensive single purchase at over NZ$ 300 after a 20% discount. But it was worth the price paid as we can sleep anywhere, including in the car by Lake Tekapo at -2°C. The extreme cold turned my bananas black.

Don’t know how to begin packing your bags for the Working Holiday experience in New Zealand? Read this guide.

Telco

I’ve stayed with Skinny for my data since my first month and paid NZ$ 16 for their lowest rollover pack. Sometime around October, I switched to Kogan for their ridiculously low NZ$ 1 data pack spread over three months. Then it was back to Skinny for the rest of the year.

Insurance

Personal insurance is a must, and I make sure I was covered for my entire stay in New Zealand under Orbit Protect. I bought it in 6-month blocks as I wasn’t sure when I’d be leaving New Zealand. Buying a year-long block gives greater savings.

Feminine Hygiene Stuff

I substituted disposable pads and tampons for the cup before embarking on the New Zealand Working Holiday, so this never came to my expense. The only feminine hygiene-related stuff I got was the period undies from a local company AWWA, which I’d highly recommend to my fellow female comrades.

Savings

Before I took the plunge and went to New Zealand, I had three goals:

- Do as many unconventional jobs as I can,

- Visit both the North and South Islands, and

- Make sure I don’t tap into my SG funds

I’m glad I achieved all three, and even had additional bonuses of

- Visited the entire country and did almost all the touristy activities

- Completed nine Great Walks and many more tracks, and

- Coming back home with savings

YOU CAN SAVE MONEY. But don’t expect to earn or save more than in Singapore if you have a well-paying job in Singapore. Manage your expectations!

Before heading to New Zealand, I went to a sharing session held by a local group on my last month in Singapore and learnt about a guy’s recount of his Working Holiday experience. His story left a strong impression on me.

The man had been to only one island, did one or two jobs, bought a nice jeep, and came back with a S$ 5,000 deficit. His story probably spurred me to be extra mindful of my money, as New Zealand can be expensive if you’re not careful, and the costs add up before you know it.

At the end of my two years, I managed to save around NZ$ 20,000, which is around what this Malaysian blogger managed to take home (NZ$ 10,000) after 9 months as well. Most working holidaymakers I met had savings, so I’m not sure how that guy managed to go into the deficit.

Budgeting Tips

For those who would like to practise money mindfulness, here are some tips to help your budgeting. However, bear in mind that the pointers below require effort, and you may have to forgo some comfort.

Outputs

- Keep track of your expenditure. Via an app or Excel sheets. I kept my receipts to key into Google Sheets once a week.

- Keep costs low for accommodation. Hotels are extravagant. When we stayed in hostels, we often went with mixed-bed options. Living out of a camper cuts costs even lower.

- Do home-cooked meals as often as you can. Eating out is pricey. Groceries are cheap, especially in Farmer’s Markets. Buy in bulk and store. Asian supermarkets sell affordable Asian groceries like leafy veggies, tofu and ginger. Potatoes, carrots, etc are still cheaper at Pak N Save. Cook your own meals! (I’ll write a post about some dishes I usually cook in due time.)

- Send your car for checks before buying. I’ve seen friends paying more than the price they paid for their car, to fix their car. It is also very frustrating to fail your WOF. Small cars like Honda Fit are great for travelling within the city, and they keep petrol costs down. Bigger cars like Mazda MPV take in more fuel but are more efficient in the long run for road trips.

- Fuel up at partnering petrol stations after your grocery runs. Pak N Save has discounts printed on the receipts. Usually 6c/ L back in 2022.

- Don’t go over the speed limit. Speeding tickets are costly!

- Book your big-ticketed activities from bookme. Most of my expensive activities were booked ahead from that local site.

- Bring your hiking gear. Or buy local brands. I insisted on Goretex boots and had mine shipped from Trekkinn because foreign brands are expensive. Buy portable camping stoves and pots and sleeping mats, or tents from Shopee, Lazada or Taobao. You could sell or donate them after that. Get your butane gas from Warehouse in New Zealand. If you have at least a month to spare, buy from Aliexpress while in New Zealand. Uniqlo thermals and down jackets are good to bring, but I’ll suggest buying discounted Icebreaker Merino thermals if you’ll be going on multi-day hikes as they don’t stink and keep you warm.

- Change to a period cup. Saved me lots of money, space and is environmentally friendly.

Inputs

- Look out for jobs that pay above minimum wages and/ or have long working hours. If you’re already staying put at a place to work, why not make full use of the time to work, earn and save for future trips. Outdoor work like cherry picking may have erratic work hours. Work but don’t go overboard and earn more than NZ$ 48,000. Taxes are crazy. Also, don’t overwork and injure yourself!

- Make sure your work pays for public holidays. We left blueberry picking for kiwi as the former wasn’t paying for two public holidays.

- Open a savings account. The Go account with ANZ does nothing apart from holding your money. Set up a savings account to earn interest, but make sure you have your IRD info logged into the system or be charged 45% tax on your interest. Take note of the penalty for withdrawing from the savings account and plan wisely.

Ending

In conclusion, the New Zealand Working Holiday should be a sustainable trip if you balance the Work (Input) and Holiday (output) aspects carefully. Aim for at least a breakeven.

If you were to compare the earnings in New Zealand vs Singapore, don’t. Taxes in New Zealand are high, which explains why I’m back in Singapore (newfound appreciation for CPF employer’s contribution)! A digital nomad might get more value for money when you consider the currency rate and taxes. But realistically, not all of us can be like that. Also, I want to visit other countries, and New Zealand is not a good base to pursue that goal.

On the bright side, you get to experience a new way of living for a year! Test how well you’d react to new environments, and practise owning your independence! These became a topic of discussion during my interviews.

You mean you have to find work and lodging yourself and there is no organisation (who?!) helping you? Aye-aye!

You get to own a car without breaking the bank like in Singapore and enjoy heartbreakingly beautiful nature parks and reserves in New Zealand. Any hikers would appreciate New Zealand. If you’re not one, you’ll turn into one.

You might also realise that what you’ve been doing in Singapore thus far isn’t what you want and change your life!

Either way, if you’re still under 31, and want to have a life-changing gap year or sabbatical, go for the New Zealand Working Holiday and have the best year of your life! I’m sure that year will take a rent-free space at the back of your mind for the rest of your life.

All the best in your planning! Comment below or find me on IG if you need more help.